COVID-19 has an ongoing impact on the day to day operations of construction companies. Construction companies need to re-think the “how” to do business and require a complete focus on core activities.

New norms of conducting business in an environment where social distancing is necessary are leading to less efficient methods of working. This is causing a level of disruption and associated loss in productivity and efficiency at every level. It ranges from how many men can work in a trench, to the logistics of having three men in a 12-man hoist for vertical construction.

This complexity makes it very difficult to foresee the future, when the cumulative knowledge is based on traditional ways of working. Unfortunately, these ways do not reflect the current environment.

Enter Octant AI

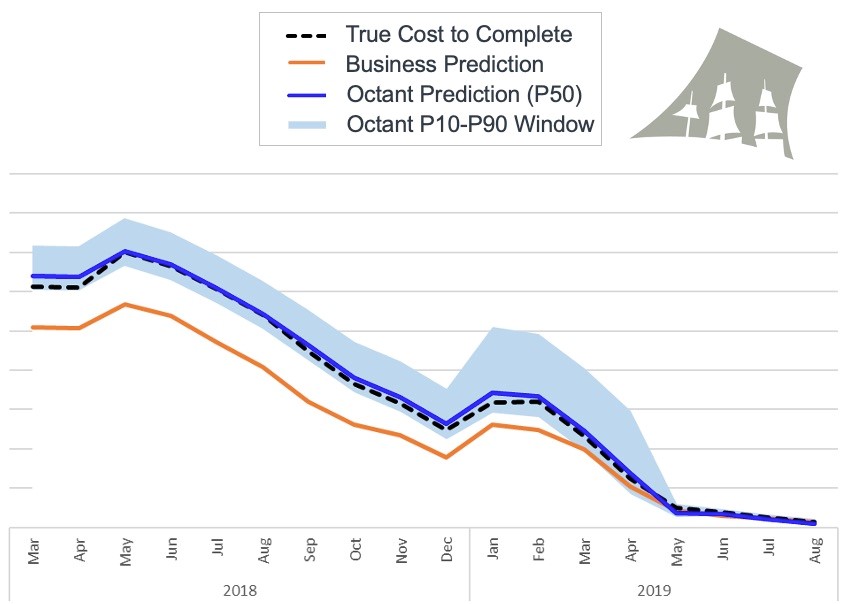

Enter Octant AI. In recent testing Octant AI demonstrated that when calibrated to P50 it can predict the forecast final cost with

extreme accuracy.

Figure 1: Octant AI prediction of final cost on a portfolio of abnormal projects, showing accuracy of Octant AI to Business.

Not only is Octant AI demonstrably better that humans for up to 70% of project duration. It provides this reliability in predicted cost at least 30% of programme duration earlier. This is a massive step-change to business norms within the industry.

Presently there would be many contractors living a scenario where COVID-19 exposes their projects to ongoing disruptive effects, such as unforeseen increasing costs. As a result, the forecast final costs are not clear, and despite best efforts by all, they remain vague. All levels of management are struggling to get reliable information quickly to understand the quantum’s involved in a changing environment. Therefore, the same questions are being asked over and over again. The answers are still best guess and come with a degree of uncertainty.

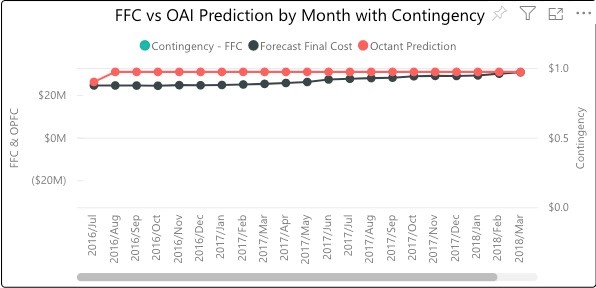

In contrast Octant AI predictions are based on years of data, learned and memorised by the AI. As a comparison, a person would have to remember and recall every cost centre for every month of every project that everybody in the business had ever constructed. They would also need to be able to associate the patterns within all this data and do the calculations to support a probability of being right about the answer. The power of AI is to do so, with no emotional or optimism bias, and within a few seconds.

This is what Octant AI is capable of. To understand the performance of product, an example of a typical comparison is

shown in Figure 2 below.

Figure 2: Typical Octant AI prediction versus business forecast, showing business forecast trending to the Octant AI prediction.

Octant and COVID-19

Consider for a moment that the use of Octant AI can establish a predicted final cost that accounts for the disruptive effects of COVID-19. Referring to Figure 1, Octant AI has a built-in band of predicted accuracy.

If we estimate that the COVID-19 disruption results in project productivity equivalent to the worst 20% of historical projects, we can adopt the Octant AI prediction factor for P80 outcomes (i.e. cost does not exceed prediction for 80% of all projects). We can use this as a basis of predicting the final out-turn cost for all projects. Octant AI has the built-in flexibility to be calibrated to generate predictions at any value for P(n). This allows to explore any range of scenarios and provides management with a reliable tool. It can model business impacts and the most likely financial outcomes. Octant AI can be tailored to suit the historical norms of the business in the context of the current COVID-19 disrupted environment.

There will always be the need for good people on site to navigate the day to day challenges of disruption. And we need them to use their best endeavours and skills acquired over decades. Using Octant AI, it can provide supplemental knowledge and predictions that correlate to a disrupted working environment. It provides management with tools that assist them to foresee the most likely future outcomes earlier and more accurately. The value of this was assessed as an increase in margin equivalent to 1% to 2.4% of annual turnover.